In today’s article, we’ll explore the cheapest way to swap crypto. To find the lowest swap fees, we’ll explore four of the cheapest crypto swap platforms out there:

- Uniswap

- PancakeSwap

- QuickSwap

- Curve

These are four decentralized exchanges (DEXs) with some of the lowest swap fees in crypto. As such, let’s have a closer look at each of them.

Complete List of the Cheapest Crypto Swap Platforms

When looking for the best altcoin exchange, people generally look at a bunch of things, including features, advantages/disadvantages, fees, etc. In this section, we’ll cover five of the cheapest crypto swap platforms to help you find an affordable alternative for you as a cryptocurrency trader.

1. Uniswap

Uniswap is the world’s first DEX (decentralized exchange). It’s also one of the cheapest crypto swap platforms, with a 0.3% swapping fee for tokens. Uniswap supports ERC-20 tokens and integrates with multiple blockchains. Furthermore, the platform facilitates cross-chain swaps between networks like Ethereum, Polygon, Arbitrum, and others.

Uniswap leverages smart contract technology to enable users to swap cryptocurrencies with one another without the need for middlemen. The platform also supports a large set of tokens, making it a good choice for swapping new as well as more established coins like Ethereum.

Key Features:

- Cross-Chain Swapping: Uniswap features support for several blockchain networks, including Polygon, Ethereum, Arbitrum, etc., and the platform allows users to swap tokens between these networks.

- High Security: Since Uniswap is a DEX, it’s highly secure since its decentralized architecture minimizes hacking risks.

- Liquidity Pool (LP): Uniswap features an LP to which anyone can deposit their tokens and provide liquidity. In doing so, they can put their asses to work and earn interest in return.

2. PancakeSwap

Another prominent example of a cheap crypto swap platform is PancakeSwap. PancakeSwap is a BNB Smart Chain-based DEX, meaning the platform is a gateway for anyone trading BSC assets. With PancakeSwap’s intuitive interface, users can seamlessly buy, sell, and swap tokens while enjoying a low transaction fee of only 0.25%.

Key Features:

- Yield Framing: Like on Uniswap, it’s possible to deposit funds to PancakeSwap’s LP to put assets to work. By depositing funds, users can earn rewards by providing the protocol with liquidity.

- High Security: PancakeSwap is also a DEX, and the decentralized nature of the platform makes it secure by removing the single point of failure many centralized exchanges have.

3. QuickSwap

QuickSwap launched back in 2020, and it’s a fork of the Uniswap platform that runs on the Polygon network. Polygon is a layer-2 (L2) scaling solution for Ethereum, meaning that QuickSwap is an L2 DEX built on the Polygon blockchain. Polygon provides lower transaction fees compared to the Ethereum mainnet. And this means that QuickSwap can facilitate token swaps at a lower cost relative to the Uniswap platform.

Furthermore, since QuickSwap originates from the Uniswap protocol, it provides the same functionality with similar liquidity protocols but with minor cosmetic changes. As such, this, for instance, means that QuickSwap users can put their assets to work by supplying QuickSwap’s LPs with liquidity.

Key Features:

- Liquidity Pools: QuickSwap users can lock in their assets to create LPs. In turn, for providing liquidity, users are rewarded 0.25% on trade fees proportional to their share in the LP.

- Low Transaction Fees: QuickSwap offers low transaction fees of only 0.3%, which is similar to the Uniswap protocol.

- Decentralization: QuickSwap is also a DEX, meaning that the platform boasts high security due to decentralization.

4. Curve

Curve, or Curve Finance, is an Ethereum-based AMM and DEX focusing on stablecoins. The platform launched in 2020 and quickly became a significant player within the decentralized finance (DeFi) space. Moreover, Curve boasts transaction and swap fees as low as 0.04%, making it a cheap crypto swap.

Key Features:

- Multi-Chain Compatibility: Curve supports multiple networks, including Ethereum, Polygon, Optimism, Arbitrum, Avalanche, and others.

- Liquidity Pools: Users can also become liquidity providers and earn yield via trading fees paid by swaps. And liquidity providers receive 50% of all trading fees. What’s more, some LPs also earn interest from lending protocols.

What is a Crypto Swap Platform?

Crypto swapping is the process of instantaneously exchanging one crypto for another without the need for a crypto-to-fiat exchange. Put simply, a crypto swap platform is a website or application facilitating this service.

To better understand how this works and why it’s needed, let’s compare swapping with trading!

In conventional trading, users execute trades based on an order book. Moreover, they can usually only trade based on the pairs offered by a particular exchange. As such, trading typically requires users to exchange one crypto for fiat and then purchase a new coin with the obtained currency.

Depending on the desired exchange, this process can become tedious as it generally requires more transactions. As such, trading can become more time-consuming and expensive as exchanges charge a fee for each transaction.

Crypto swapping eliminates these issues by providing a more straightforward process to swap one crypto for another instantly. This means you can minimize the number of transactions, saving you both time and money.

So, now that you have an overview of what a crypto swap platform is, let’s explore what makes one cheap vs. expensive!

What Makes a Crypto Swap Site Cheap vs. Expensive?

There are several factors impacting the price of a crypto swap platform; however, three key deciding factors are transaction fees, token prices, and gas prices:

- Transaction Fees: Each crypto swap platform can set its own transaction fees. However, you usually pay somewhere between 0.25% to 0.3% in swap fees on a DEX. Nevertheless, the transaction fee can drastically affect whether or not a swap site is cheap vs. expensive.

- Token Prices: Even though different exchanges might offer the same tokens, the prices can slightly differ, creating arbitrage opportunities. As such, Ethereum might sell for one amount on Uniswap and another on other platforms.

- Gas Prices: Another important factor to take into account are gas prices. You must pay a gas fee for each transaction you conduct. And all blockchain networks have their own prices.

For instance, transactions on the Ethereum network are usually relatively high compared to an L2 scaling solution like Polygon. As such, if you’re looking for the cheapest crypto swap, you need to consider the underlying blockchain network.

However, one way to get the best prices is to leverage a DEX aggregator like 1inch. 1inch splits orders among various exchanges to achieve the best rates possible. And 1inch supports many liquidity protocols, including Uniswap, SushiSwap, etc.

Consequently, one way of finding the cheapest way to swap crypto is to use a platform that leverages the 1inch aggregator.

Summary: Cheapest Crypto Swap Platforms – Lowest Swap Fees in Crypto

In today’s article, we explored four of the cheapest crypto swap platforms available:

- Uniswap

- PancakeSwap

- QuickSwap

- Curve

Bofero you can jump over to any of these sites, you need to know what tokens deserve your attention in the first place. Well, this is where Moralis enters the scene!

Moralis has a lot more to offer. If you’d like to learn more, check out our article on three crypto trading tips everyone should know!

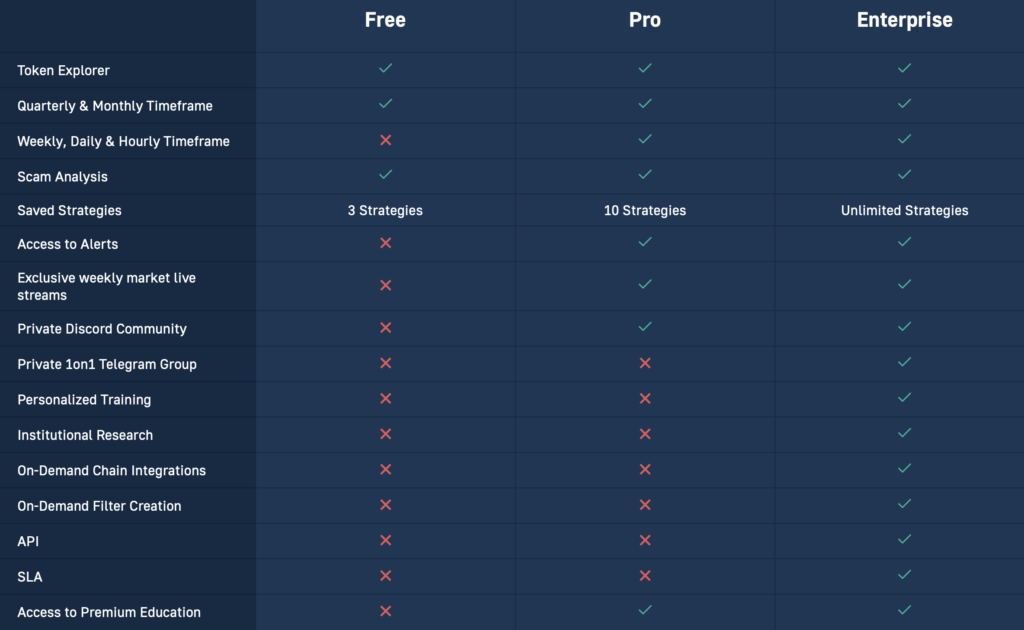

Also, did you know that you can maximize your crypto gains and the value of Moralis by subscribing to the Moralis Pro plan? As a Pro plan user, you get narrower timeframes for all search parameters, access to a private Discord server, access to Token Alerts, and much more:

If you’d like to try it out, sign up for our seven-day trial today by heading over to our pricing page.

Using the interactive widget below, you can also take Moralis Token Explorer for a test drive. Apply a premade filter, or create a new strategy from scratch by combining the metrics of your choice: