As we dive into today’s article, we’ll start by ensuring everyone understands the concept of a crypto ETF. We’ll briefly cover the fundamentals and then examine specific aspects of crypto ETFs. Following that, we’ll explore the widely held belief that the recently approved spot Bitcoin ETFs in the US could be a game-changer for the crypto industry. In doing so, we’ll look into the potential impact these new ETFs might have on the overall crypto market.

Moving forward, we’ll provide an updated list of newly approved crypto ETFs, effective January 10, 2024. Additionally, we’ll guide you on investing in a Bitcoin ETF, discuss key considerations for investing in crypto ETFs, and explain why the non-custodial approach to crypto investment is generally superior for most investors. Moreover, we’ll compare investing in a crypto ETF vs. buying crypto in a self-custodial manner. There will also be a dedicated section explaining the optimal way to invest in cryptocurrency ETFs.

Lastly, we’ll introduce you to Moralis – a leading crypto trading tool that simplifies the process of investing in crypto, making it as straightforward as possible.

What is a Crypto ETF?

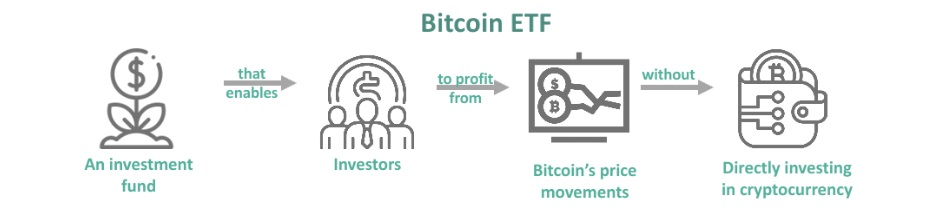

A crypto ETF is an “exchange-traded fund” that revolves around a specific cryptocurrency. A cryptocurrency ETF is a financial product that tracks the performance of one or a group of assets. Don’t confuse an ETF with a spot ETF, where the regular ETF simply tracks the performance. A spot crypto ETF – such as a spot Bitcoin ETF – is an exchange-traded fund that directly holds and tracks the physical cryptocurrency it represents, providing investors with direct exposure to the underlying digital assets rather than deriving their value from cryptocurrency futures contracts.

If you want to understand better what crypto ETFs are, you need to know what cryptocurrencies are and what ETFs are. Then, you can simply combine the understanding of the two concepts. So, let’s break this down together in the next section!

Cryptocurrencies Simply Explained

Cryptocurrencies, also known as “cryptos,” are digital or virtual currencies. They use cryptography for security and run on various blockchain networks, which are essentially digital ledgers.

Bitcoin ($BTC) was the first cryptocurrency born in 2009 and continues to be one of the best-known examples of digital assets. However, there are thousands of other cryptocurrencies in 2024. Ethereum, Ripple, Solana, Cardano, and Litecoin are some of the most popular assets. All cryptos that are not Bitcoin go by the term “altcoins.”

Ideally, these digital assets operate on properly decentralized (not always the case) networks based on blockchain technology. This provides transparency and security to their on-chain transactions.

What are ETFs?

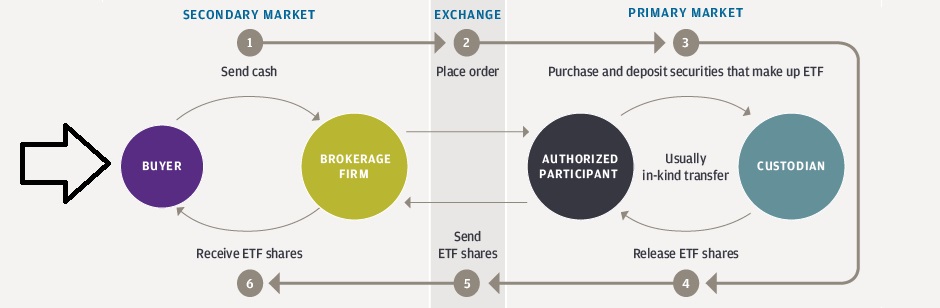

ETFs stands for exchange-traded funds. Much like individual stocks, you can trade ETFs on stock exchanges. After all, they are just specific investment funds.

Typically, an ETF pools together several assets, such as commodities, stocks, or bonds. Then, it offers investors the ability to buy shares of that fund. An ETF can also focus on a single asset, which is the case in a spot Bitcoin ETF.

ETFs are known for their liquidity and low expense ratios. Plus, they tend to provide investors with flexibility in terms of buying and selling throughout the trading day at market prices.

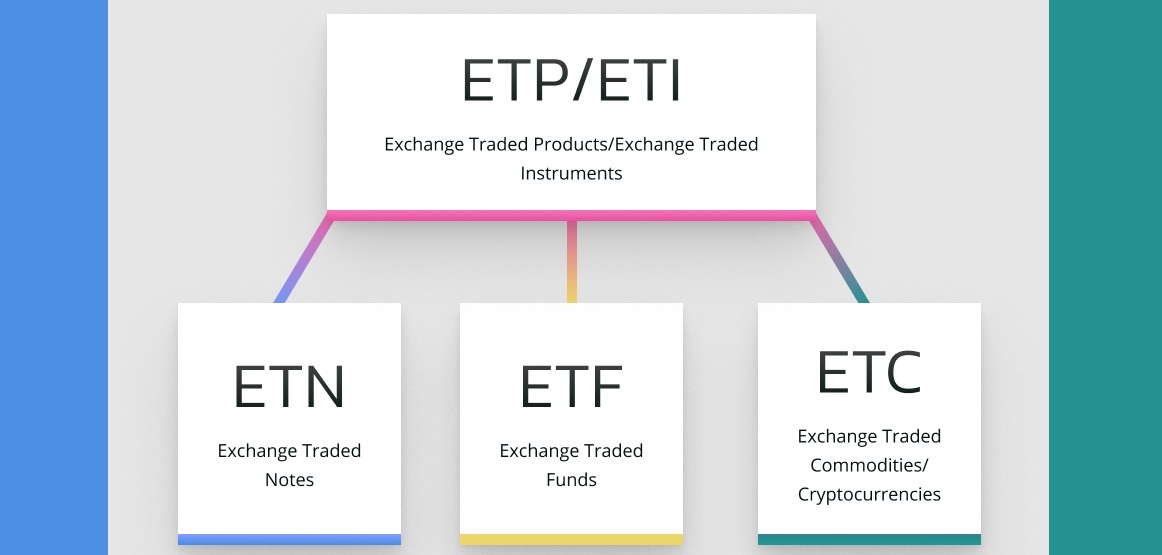

ETPs vs. ETFs: Understanding the Difference

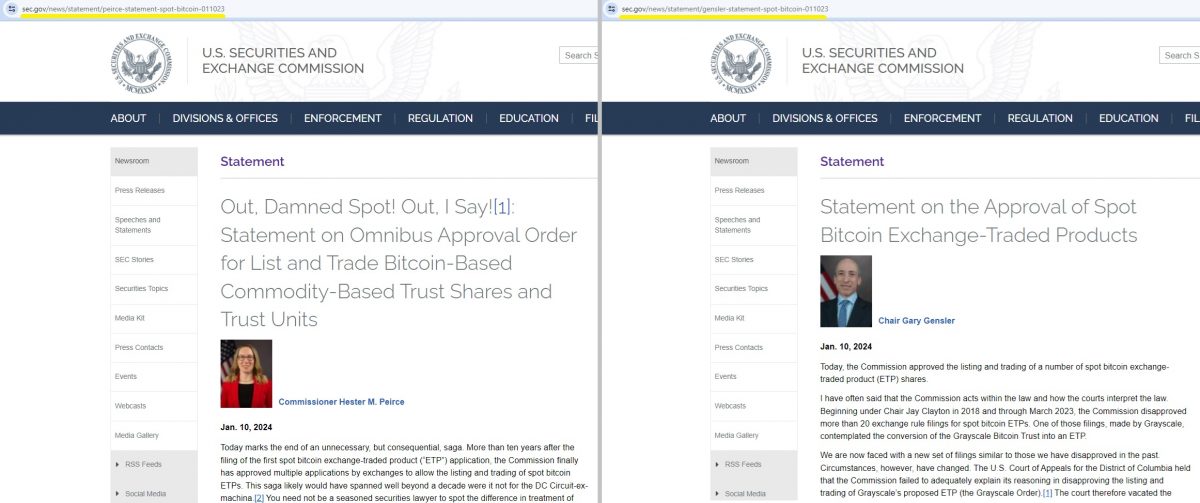

While often used interchangeably, it’s essential to distinguish between exchange-traded products (ETPs) and exchange-traded funds (ETFs). ETPs represent a broader category that includes ETFs. All ETFs are ETPs, but not all ETPs are ETFs. The recent SEC crypto ETF approval specifically focuses on ETFs, indicating that they meet specific regulatory criteria. However, in SEC Commissioner Hester M. Peirce’s statement – published on SEC’s official website on January 10, 2024 – the commissioner addresses these ETFs as ETPs, which is the umbrella term.

Crypto ETFs – Putting it All Together

A crypto ETF, or cryptocurrency exchange-traded fund, combines the features of traditional ETFs with the world of cryptocurrencies. It allows investors to gain exposure to digital currencies without directly owning them. In the context of the recent SEC approval, here’s a breakdown of specific aspects:

- Tracking Cryptocurrency Prices – Crypto ETFs track the prices of cryptocurrencies, such as Bitcoin, providing investors with a convenient way to participate in the crypto market without the complexities of owning and managing digital assets.

- Market Surveillance Mechanisms – To address concerns about market manipulation, crypto ETFs incorporate market surveillance mechanisms. For instance, Nasdaq and CBOE have established monitoring systems with cryptocurrency exchanges like Coinbase, enhancing regulatory oversight.

- Accessibility and Investor-Friendly Approach – Unlike directly owning cryptocurrencies, which involves setting up Web3 wallets and dealing with cybersecurity concerns, crypto ETFs are listed on regulated stock exchanges. This makes them accessible to investors through existing brokerage accounts, providing a more friendly approach for old-school investors.

- Fees and Liquidity Dynamics – Fees for crypto ETFs typically range from 0.20% to 0.8%, offering competitive options for investors. The dynamics of liquidity play a crucial role, especially for short-term speculators, influencing the ease of buying and selling these funds.

All in all, a crypto ETF is a financial instrument that brings the characteristics of traditional ETFs to the world of cryptocurrencies. It offers a regulated, accessible, and investor-friendly avenue for individuals and institutions to engage with the evolving landscape of digital assets. The recent SEC approval of spot Bitcoin ETFs marks a pivotal moment, potentially shaping the future of how investors interact with and perceive cryptocurrencies.

Crypto ETFs, a Game-Changer for Crypto?

Any approval of crypto ETFs is perceived as an important recognition for crypto. There have been many cryptocurrency ETF approvals across the globe so far, including several spot Bitcoin ETFs. However, since the USA represents the largest market in the world, these newly approved spot Bitcoin ETFs have much more weight.

The direct impact of SEC’s approvals announced on January 10, 2024, has yet to reveal itself, but it’s safe to say that this was a significant milestone for the cryptocurrency industry. If nothing else, it boosts the legitimacy of Bitcoin and cryptocurrencies in general, pushing them further into the mainstream financial landscape. In addition, there’s also the potential for substantial money inflows. According to some projections by various Bitcoin ETF managers, billions of dollars are ready to enter through these channels. This potential capital further underscores the growing acceptance of digital assets.

What Impact Will a Spot Bitcoin ETF Have on the Crypto Market?

These new crypto ETFs open the gates to users stuck with traditional finance. This means that users who are reluctant to buy crypto with Web3 wallets (typically older generations) can now invest in this new asset class via familiar instruments. Since spot Bitcoin ETFs actually hold Bitcoin, their performance should closely follow Bitcoin’s price. As such, it should have a direct impact on the price. In the long run, this may also stabilize the price of Bitcoin as the asset’s market cap increases. However, only time will tell how the market will end up reacting. After all, it’s nearly impossible to know which effects are caused directly by the money inflows into these ETFs or by the market’s excitement that these highly-anticipated approvals brought to the crypto space.

So far, the prices of Bitcoin and many altcoins have reacted positively. Since the announcement on January 10, 2024, at 9 PM UTC, the Bitcoin price has increased by more than 8% over the upcoming 17 hours, nearly reaching $49K. However, at the time of writing, the $BTC price is back around $46.2K, after already dipping to approximately $45.8:

Also, the Bitcoin dominance has been declining, indicating that altcoins are getting more attention.

The bottom line is that the crypto markets have their own beat, and so far, all extraordinary events have ended up lining up with that rhythm. Hence, we must wait some time to see how the market reacts to these newly approved spot Bitcoin ETFs.

Crypto ETF List: Highlighting Newly Approved Cryptocurrency ETFs

Here’s a crypto ETF list of eleven newly-approved ETFs:

- Grayscale Bitcoin Trust

- ARK 21Shares Bitcoin ETF

- Bitwise Bitcoin ETF Trust

- BlackRock’s iShares Bitcoin Trust

- VanEck Bitcoin Trust

- WisdomTree Bitcoin Trust

- Invesco Galaxy Bitcoin ETF

- Fidelity’s Wise Origin Bitcoin Trust

- Valkyrie Bitcoin Fund

- Hashdex Bitcoin ETF

- Franklin Bitcoin ETF

Note: We advise you to read SEC’s statements regarding the agency’s ETF approvals before moving forward with any of the above-listed crypto ETF options:

Other Cryptocurrency ETFs

The above crypto ETF list is all about spot Bitcoin ETF in the USA. However, there have been many other crypto ETFs approved worldwide before January 10, 2024. Some of these ETFs represent cryptocurrencies directly, while others represent shares of companies heavily involved in the crypto industry. The most prominent examples include:

- Amplify Transformational Data Sharing ETF (BLOK) (companies actively involved in crypto)

- Valkyrie Bitcoin Strategy ETF (BTF) (Bitcoin futures contracts)

- Siren Nasdaq NexGen Economy ETF (BLCN) (companies actively involved in crypto)

- Global X Blockchain & Bitcoin Strategy ETF (BITS) (Bitcoin futures contracts)

- Bitwise 10 Crypto Index Fund (BITW) (Bitcoin, Ethereum, Cardano, Solana)

- VanEck Bitcoin Strategy ETF (Bitcoin futures contracts)

- ETC Group Physical Bitcoin (Germany – directly invested in spot Bitcoin)

- 21Shares Bitcoin ETP (Switzerland – directly invested in spot Bitcoin)

- QR Capital’s Bitcoin ETF (Brazil – directly invested in spot Bitcoin)

- 3iQ Coinshares (Canada – directly invested in spot Bitcoin)

- Purpose Bitcoin (Canada – directly invested in spot Bitcoin)

- CI Galaxy Bitcoin (Canada – directly invested in spot Bitcoin)

- Global X 21Shares Bitcoin ETF (EBTC) (Australia – directly invested in spot Bitcoin)

- VanEck Bitcoin ETN (Liechtenstein – directly invested in spot Bitcoin)

- CoinShares Physical Bitcoin (BITC) (Jersey – directly invested in spot Bitcoin)

- WisdomTree Physical Bitcoin (BTCW) (Jersey – directly invested in spot Bitcoin)

- Invesco Physical Bitcoin (BTIC) (Jersey – directly invested in spot Bitcoin)

- Valour Bitcoin Carbon Neutral (1VBT) (Jersey – directly invested in spot Bitcoin)

- SEBA Bitcoin ETP (SBTCU) (Guernsey – directly invested in spot Bitcoin)

- SEBA Bitcoin CHF Hedged ETP (SBTCC) (Guernsey – directly invested in spot Bitcoin)

- Jacobi FT Wilshire Bitcoin ETF spot Bitcoin ETF (BCOIN) (Guernsey – directly invested in spot Bitcoin)

Note: The crypto ETF list above is not complete as it only includes the most prominent options.

How to Invest in Bitcoin ETF

Investing in a Bitcoin ETF is rather simple. Below is a straightforward guide for both US and international investors.

How to Invest in Crypto ETFs for US Investors

- Choose a Brokerage Account: Open an account with a US-based brokerage platform that supports ETF trading.

- Research Available Bitcoin ETFs: Explore the Bitcoin ETFs available on the platform. You can use the above crypto ETF list of eleven newly approved providers.

- Fund Your Account: Deposit funds into your brokerage account.

- Place an Order: Navigate to the trading section of your brokerage platform, search for the specific Bitcoin ETF you want, and place a buy order. Choose the number of shares you wish to purchase.

- Monitor Your Investment: Keep an eye on your investment through the brokerage platform. You can track the performance of your Bitcoin ETF in real time.

How to Invest in Crypto ETFs for International Investors

- Select an International-Friendly Platform: If you’re outside the US, choose a platform that allows international investors to trade US-listed ETFs or focus on non-US ETFs. Use the crypto ETF list above.

- Check Regulatory Requirements: Be aware of any specific regulatory requirements or restrictions in your country regarding investing in US-based ETFs.

- From that point on, the “invest in Bitcoin ETF” process is similar to that of US investors. So, open an account, research available Bitcoin ETFs, fund your account, place an order, and monitor your investment.

Things to Consider When Investing in Crypto ETFs

While Bitcoin tends to perform very well in general, things still boil down to proper timing. As such, note that when investing in $BTC (even via ETFs), you can lose as much as 80% in a matter of months. To avoid such losses as you invest in Bitcoin ETF, consider these tips:

- Diversify Your Portfolio: By diversifying your overall investment portfolio, you take a balanced approach.

- Stay Informed: Keep yourself updated on cryptocurrency market trends and news. Prices can be volatile, so staying informed is crucial.

- Understand Fees: Be aware of any fees associated with buying, selling, or holding the Bitcoin ETF. Different platforms may have varying fee structures.

The above tips are essential to the “how to invest in crypto ETF” consideration. So, make sure to keep them in mind as you take any further action. After all, you probably wish to invest in Bitcoin ETF to make profits, right?

So, before investing in crypto ETFs, you should also ask yourself if this is the right path for you. Also, like most cryptocurrency investors, you may prefer to actually own your digital coins and tokens in non-custodial wallets.

Not Your Keys, Not Your Crypto!

The phrase “not your keys, not your crypto!” is widely used in the crypto space. This statement warned users who kept their cryptocurrencies on centralized exchanges (CEXs) to move their assets elsewhere. However, it now also applies to folks wondering how to invest in crypto ETFs. After all, if you buy a crypto ETF, you do not actually own the cryptocurrency.

While many investors may find the non-custodial approach (buying the asset without using a third party) technically too challenging, we believe you are not one of those people. We urge you to set aside your “how to invest in crypto ETF” question and instead ask yourself if it would be better to truly own your cryptocurrencies. After all, the foundation of blockchain technology is all about peer-to-peer interactions and true ownership without any middlemen.

The Best Way to Invest in a Crypto ETF

We could go into details about how to invest in crypto ETF in the best way; however, we won’t. Why? Well, because there are many better ways to invest in crypto. Plus, the biggest gains are not always in Bitcoin but in altcoins!

So, what’s the best way to invest in a crypto ETF? It is not to invest in cryptocurrency ETFs but instead utilize decentralized methods. A decentralized approach to investing in crypto is the best path in our opinion. After all, creating and using a hot non-custodial crypto wallet and combining it with a hardware crypto wallet is a lot simpler than most beginners think.

So, if you want to invest in cryptocurrencies, this is the path we recommend. That way, you’ll be able to access the best opportunities, including those 50x-plus altcoin gems. Plus, you’ll be in control of your assets.

Investing in Crypto Made Easy: Introducing Moralis

You can use many great cryptocurrency analysis sites to invest in crypto. Many of these sites offer powerful crypto analysis tools. However, there’s no other tool that combines the power of real-time, on-chain insights with user-friendliness like Moralis.

As mentioned above, altcoins are the cryptocurrencies where the biggest opportunities lie. This is why Moralis focuses on these types of crypto assets. The platform offers numerous tools that allow you to monitor the altcoin markets and easily spot the best opportunities.

For instance, just by visiting the Moralis homepage, you can enjoy the power of crypto bubblemaps. They offer an intuitive and fast way to see daily winners and losers and get an overall sense of the market. Plus, for users on the Moralis Pro or Starter plan, the homepage also offers the “Top Tokens on the Move” option.

However, crypto bubbles are just a small fraction of what this platform has to offer. It also gives you access to a crypto whale tracker, crypto pump detector, instant crypto swap feature, and much more. The most powerful tool in the Moralis arsenal, however, is its crypto scanner known as Token Explorer.

This core feature enables you to deploy preset or unique search strategies with just a few clicks. In response, you get dynamic lists of altcoins with potential:

By simply clicking on any of the tokens from the list, you land on that crypto’s page, where you can properly research the asset:

Moralis Starter and Pro users enjoy the best crypto charting tool – Money Line. This ultimate trend indicator alone can turn you into a successful crypto investor, the one that skillfully avoids crypto liquidations.

What is a Crypto ETF, and are Crypto ETFs a Game-Changer? – Key Takeaways

- On January 10, 2024, the SEC finally approved eleven spot Bitcoin ETFs.

- Based on the stats from other countries, investors prefer spot crypto ETFs over futures options.

- Crypto ETFs are cryptocurrency exchange-traded funds that utilize established channels that are recognized by traditional finance (TradFi) to offer investors a way to speculate on crypto prices.

- While a crypto ETF may be the most optimal path to invest in Bitcoin for an average boomer, it is typically not for the younger generation.

- A much better path, one filled with greater opportunities, awaits those ready to explore the world of DeFi (decentralized finance).

- If you are interested in finding the best crypto opportunities, you ought to use Moralis.

- If you want the ultimate edge, make sure to opt for the Moralis Pro or Starter plan.

In case you decide to invest in Bitcoin ETFs, we wish you all the best. However, if you are ready to take that red pill and dive into the realm of crypto as intended, then make sure to dive into Moralis and today!