Moving forward, you’ll have the opportunity to gain insights into the CTSI crypto. We’ll begin with a comprehensive overview of the Cartesi project. However, as investors or traders in altcoins, our primary focus lies in analyzing the Cartesi token. As such, we’ll dive into a detailed examination of the CTSI cryptocurrency. This is where you’ll discover the token’s purpose, use cases, and tokenomics. Additionally, we will conduct an analysis of the Cartesi token’s price, examining its entire price history and employing the fundamentals of technical analysis (TA) to identify key levels of support and resistance.

In addition to utilizing TA, we will leverage the ultimate crypto charting tool, Money Line, to chart $CTSI. This will provide a deeper understanding of the current CTSI price. What’s more, we will clarify how you can harness the capabilities of one of Moralis cryptocurrency analysis sites (a.k.a. token page) to assist you in making informed decisions on when or if to purchase $CTSI. This particular page offers invaluable real-time, on-chain metrics.

Last but certainly not least, for those contemplating acquiring a stake in the Cartesi token, we will offer some useful info.

What is CTSI Crypto?

“CTSI crypto” is an abbreviation for the “CTSI cryptocurrency,” which serves as Cartesi’s native fungible token. It’s worth noting that it’s not uncommon for this abbreviated term to be used interchangeably to also denote the entire Cartesi project.

Now, in order to answer the above question properly, we ought to cover the basics of the Cartesi project and its token. So, without further ado, let’s begin by looking closer at the Cartesi project!

Exploring the Cartesi Crypto Project

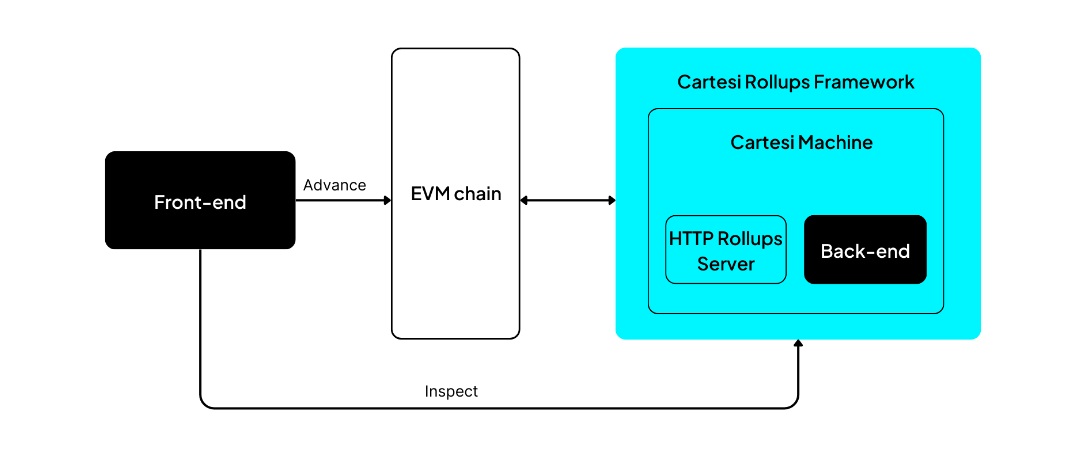

Cartesi presents itself as a revolutionary blockchain project that aims to bridge the gap between decentralized systems and real-world computations. At its core, Cartesi strives to make decentralized applications (dapps) more versatile and powerful by incorporating real-world computations into the blockchain.

So, unlike traditional smart contracts that are limited by computational constraints, the Cartesi crypto project introduces a scalable off-chain infrastructure. This infrastructure allows complex computations to be executed off-chain. As such, the process preserves the security and decentralization of blockchain technology while enhancing its capabilities.

CTSI Crypto’s Decentralized Computation Layer

Cartesi’s groundbreaking decentralized computation layer empowers developers to run intensive computations outside the blockchain. This layer acts as an off-chain scaling solution, enabling the execution of complex tasks without compromising decentralization. By doing so, Cartesi provides a platform for developers to build dapps that can handle intricate computations. This approach opens doors to a myriad of real-world use cases.

Linux-Compatible Virtual Machine: A Familiar Development Environment

In a bid to enhance developer experience and streamline adoption, Cartesi introduces a Linux-compatible virtual machine (VM). This VM enables developers to work in a familiar environment, leveraging mainstream software components and tools.

This compatibility allows for seamless integration of traditional software stacks with blockchain technology. As such, it makes it easier for developers to transition into the decentralized space.

Optimized for Decentralized Finance (DeFi)

With a specific focus on the booming realm of decentralized finance (DeFi), Cartesi optimizes its infrastructure to support complex financial computations. By offering a scalable and efficient environment, Cartesi aims to contribute to the growth of DeFi applications, making them more robust and accessible. This optimization plays a crucial role in advancing financial inclusion within the decentralized ecosystem.

CTSI crypto’s network also offers a staking mechanism, which is an important part of the project’s DeFi-focused efforts. Staking, in the context of Cartesi, involves participants contributing their CTSI tokens to the network, thereby gaining the opportunity to validate transactions, secure the network, and earn rewards. This process is integral to the overall functionality and security of the Cartesi blockchain.

Note: If you wish to dive deeper into any of the core aspects of the CTSI crypto project, make sure to visit the Cartesi documentation:

What is the Cartesi Token?

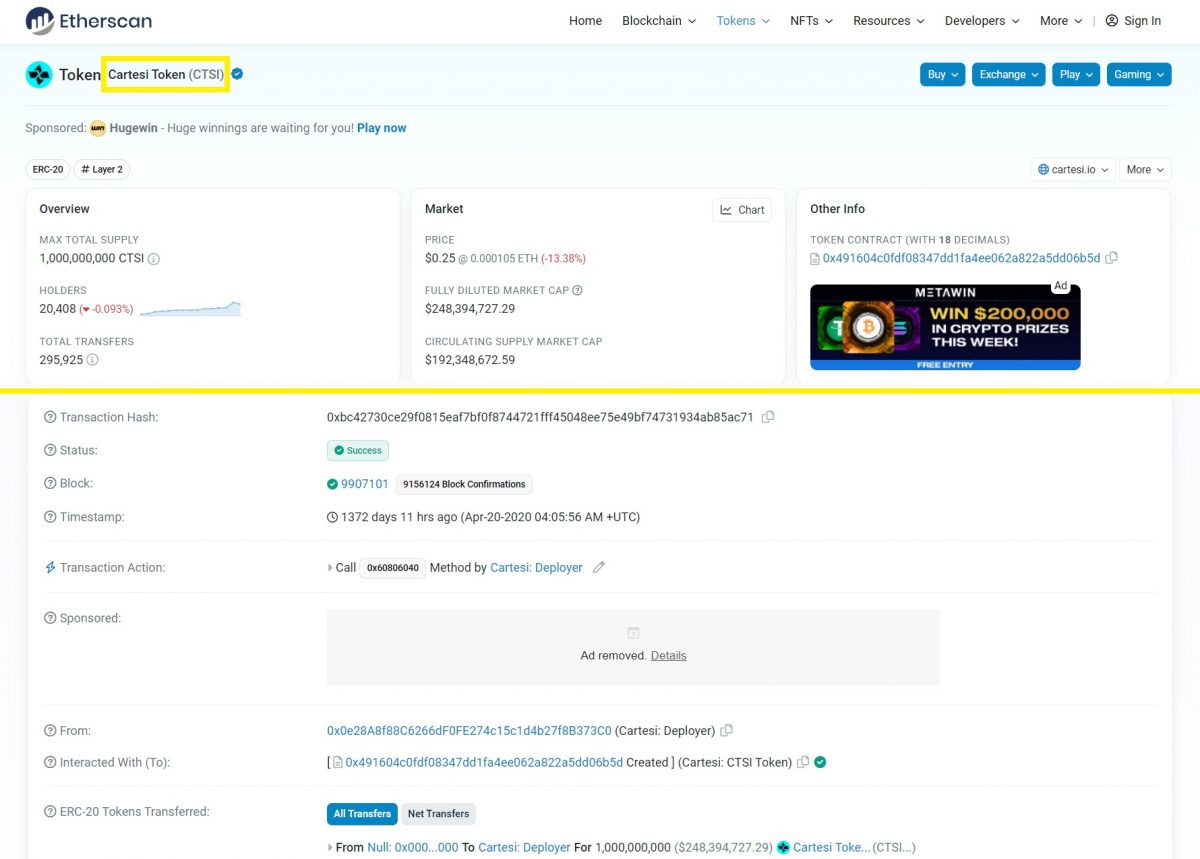

At the heart of the Cartesi ecosystem lies its native cryptocurrency, the Cartesi token (CTSI). Born from the above-presented vision of revolutionizing decentralized computing, CTSI is an ERC-20 utility token. This means it lives on the Ethereum blockchain to propel the Cartesi platform’s functionality.

So, as an integral element of the network, CTSI serves as the fuel powering the dapp, smart contracts, and staking mechanisms within the Cartesi ecosystem.

CTSI Crypto’s Purpose and Use Cases

The purpose and use case of the CTSI crypto token entitle the following:

- Enabling Dapps: CTSI acts as the lifeblood of the Cartesi platform, granting users access to dapps that operate seamlessly on the blockchain. By utilizing $CTSI, developers can leverage Cartesi’s infrastructure to create powerful and scalable dapps.

- Staking and Network Security: One of the primary use cases of CTSI lies in the staking mechanism. This is where users lock their tokens to participate in securing the Cartesi network. Aside from fortifying the network against potential threats, this also allows users to earn rewards by actively contributing to its maintenance. The staking process, powered by the Cartesi token, is a cornerstone of the project’s commitment to decentralization and community involvement.

- Transaction Fees: Beyond being a transactional currency, it serves as the medium for paying transaction fees within the platform.

- Governance: CTSI plays a pivotal role in governing the Cartesi ecosystem. Holding CTSI grants users governance rights, enabling them to partake in decision-making processes related to the network’s development, upgrades, and overall governance.

Cartesi Token Tokenomics

The total supply of CTSI is capped at one billion tokens, which is designed to instill scarcity, potentially influencing the token’s value over time as demand and adoption increase. Furthermore, users receive the above-mentioned staking rewards denominated in CTSI. As such, this mechanism encourages community involvement and, at the same time, regulates the token’s circulation.

Cartesi employs a deflationary mechanism to regulate the token supply. To reduce the overall supply of the CTSI crypto, a portion of transaction fees, generated within the ecosystem, is periodically burned. This deflationary approach also has the potential to impact the token’s value over time positively.

The CTSI tokenomics in a nutshell:

- Token’s on-chain name: Cartesi token

- Symbol/ticker: CTSI or $CTSI

- Networks:

- Ethereum (initially)

- BNB Chain

- Polygon

- Avalanche

- Optimism

- Arbitrum

- Token type on Ethereum: ERC-20

- Smart contract address on Ethereum: 0x491604c0fdf08347dd1fa4ee062a822a5dd06b5d

- Maximum total supply: 1,000,000,000 $CTSI (warning: the token is mintable)

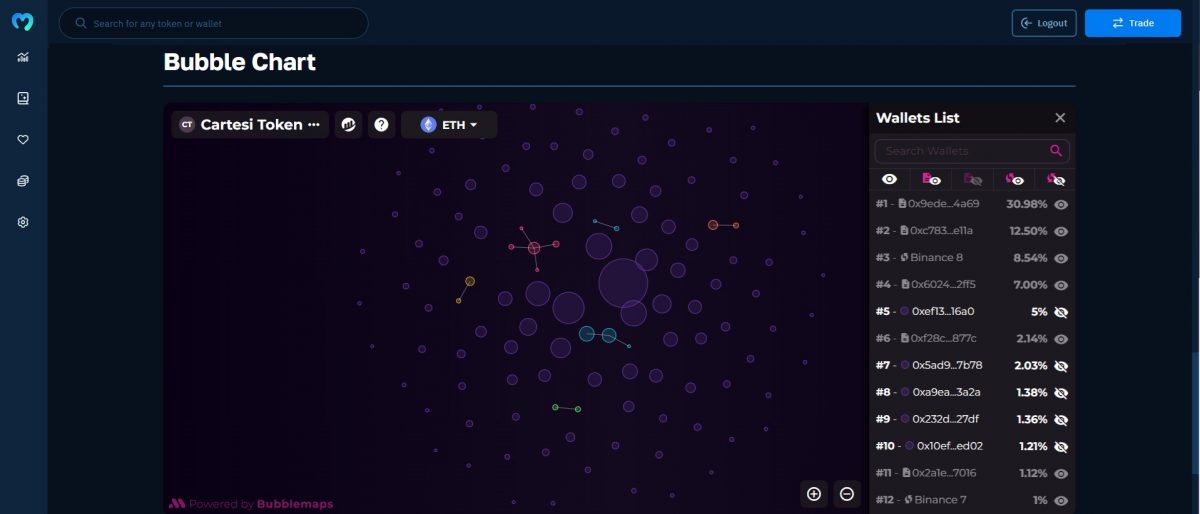

- Token distribution: You can explore the live $CTSI distribution via the bubble chart on the Moralis Cartesi token page (link in the “Should I Buy $CTSI?” section below):

CTSI Crypto Token Price Analysis

The Cartesi token started trading on April 23, 2020, at $0.015. The asset’s price spiked to $0.098 on the first day; however, its daily candle closed significantly lower – at $0.057. On the second day, the price continues to go lower. This trend went on until May 12, 2020, when the asset found support at $0.026.

After this local low, the $CTSI price climbed slightly; though, it mainly traded sideways between the $0.03-$0.04 range until July 8, 2020. After breaking out of that range, the token pulled off quite a rally, taking the $CTSI price to $0.149 on August 18, 2020. However, the coin didn’t have enough momentum to sustain those levels; instead, it reversed its trend.

By October 20, 2020, CTSI revisited the aforementioned low at $0.026. From there, the token started to increase in value again. After breaking through the previous resistance levels, $CTSI really exploded. Of course, there were some larger pullbacks along the way; however, essentially, the token’s price reached $1.75 on May 9, 2021. That value still stands as the CTSI ATH (all-time high) price.

So, from the October 2020 bottom, that was a massive 67x rally!

After that peak in May, the CTSI crypto pulled back by 82%, finding new support on June 22, 2021, at $0.31. About a month later, the token confirmed that support and used it as a starting point for another run. This time, the price increased by roughly 440% over the next 114 days, peaking out on November 11, 2021, at $1.73.

Unable to set a new ATH, $CTSI turned downward with the rest of the crypto market.

2022 Bear Season and Bottoming Out

The end of 2021 wasn’t easy on Cartesi – the asset closed the year 60% below its November peak. However, 2022 was able to pull the CTSI price even lower. On November 9, 2022, the token dipped to $0.09, which marked the new local low.

After finding support around the $0.1 mark, Cartesi started to recover. It first showed some strength in early December 2022; however, at the time, the asset didn’t have enough momentum, and it retested the $0.1 level.

The beginning of 2023 woke up most of the crypto market, and CTSI also reacted positively. By April 19, the price reached $0.36. But it was rejected there, and the token pulled back and revisited the $0.1 region.

The asset’s value stayed close to the aforementioned support until October 20, when it again started to move higher. That run reached $0.24 by December 27, 2023. Then, it entered a 32% correction that bottomed on January 19, 2024.

Next, $CTSI gained momentum again, exploding from $0.16 to $0.32 in less than three days. This latest pump was also supported by an increased trading volume.

However, since then, the price has pulled back approximately 23% and is currently trading at $0.24.

TA & Money Line

In the above weekly $CTSI chart, we marked all the key levels of support and resistance. As such, you can clearly see that at the time of writing, the Cartesi token is in a slight retrace after facing one of the most important resistance levels at $0.31.

However, if $0.22 manages to hold, we could soon see $CTSI try to break higher. This is further indicated by Money Line. After all, this ultimate crypto indicator shows that Cartesi is in a bullish trend on both weekly and daily timeframes:

Note: If you wish to get your hands on the Money Line indicator, make sure to opt in for the Moralis Pro or Starter plan. However, you can also experience this powerful crypto trading tool firsthand with the platform’s affordable 7-day trial.

Should I Buy $CTSI?

Since we are not financial advisors, we cannot answer the above question on your behalf. Plus, only you know if your current financial situation and your risk aversion allow you to invest in an altcoin like the CTSI crypto.

So, if these aspects give you the green light, then make sure to consider the above-covered sections. They offer more than enough details for you to decide if CTSI deserves your attention. If yes, then you ought to properly DYOR this altcoin.

Luckily, you can do this easily with the Moralis Cartesi token ($CTSI) page. It provides you with all the tools and resources you need to answer the above questions with confidence. Particularly valuable are the “Price Chart” and “Alpha Metrics” sections.

After all, they provide you with insights into $CTSI’s live price and real-time on-chain data. And as you may know, these types of insights allow you to determine if now is a good time to buy the token.

So, to determine if/when to buy the Cartesi token, follow the above “$CTSI” link or use the interactive widget below.

Where to Buy Cartesi Token?

If you decide you wish to get a bag of $CTSI, you have several options. Just use the “Market” section on the CoinGecko or CoinMarketCap page for that token. There, you’ll find a list of all CEXs and DEXs that offer the relevant training pair, including the trading volume. As such, you can easily pick a market that best suits your goals.

Is CTSI Crypto a Good Investment? On-Chain Data & Price for the Cartesi Token – Key Takeaways

- The Cartesi project is all about offering a rollup scaling solution to facilitate dapp development.

- Cartesi offers staking opportunities to all CTSI crypto holders.

- The Cartesi token also grants access to dapps on its network, supports network security, facilitates transaction fees, and serves as a governance token.

- $CTSI started trading in 2020 at $0.015, peaked at $1.75 in 2021, and bottomed at $0.09 in 2022. Since then, the price recovered and is currently near an important resistance level.

- To determine if/when to buy $CTSI, use the power of Moralis token page for that cryptocurrency.

- If you decide to buy Cartesi tokens, find a DEX or CEX that has a sufficient trading volume for that crypto.

Whether you end up investing in CTSI or not, do not forget about other altcoin opportunities. After all, there are many alts that offer 10x, 50x, 100x, and even higher gains in a bull market. So, all you need are reliable crypto analysis tools to spot these types of opportunities.

Luckily, Moralis specializes in that area with its powerful crypto scanner. The latter empowers you to deploy preset or unique search strategies to find tokens with potential early. Moreover, this tool also includes several automation features that allow you to turn it into the ultimate crypto pump detector.

So, if you wish to make the most of altcoin opportunities, make sure to get going with Moralis blockchain analytics tools and crypto trading tools today!