There are plenty of on-chain analysis tools helping traders make informed investment decisions. So, in addition to an “on chain analysis” introduction, we’ll also introduce you to the premier on-chain trading indicator: Moralis.

Moralis leverages real-time, on-chain data, presenting it in a readable and understandable format. As such, with this tool, you can easily analyze what is happening on chain!

If you’d like to immediately try out the number one on-chain analysis tool for free, you can do so using the interactive widget below. Use one of Moralis preset filters, or set up a custom search query from scratch using various search parameters:

Nevertheless, without further delay, let’s explore the intricacies of on-chain analysis!

What is On-Chain Analysis?

Blockchain networks run on distributed ledger technology. This means that each network broadcasts all on-chain transactions. Moreover, nodes of each network maintain complete records of these transactions.

These immutable, distributed ledgers are auditable by all network participants and outsiders, giving investors and traders unprecedented access to data compared to conventional financial markets. As such, anyone can track all trades, deposits, and interactions by and between network participants. This data availability lays the foundation for on-chain analysis.

So, what is on-chain analysis?

On-chain analysis is a strategy where traders examine public blockchain transaction activity. In doing so, they aim to understand how investors respond to market forces and determine emerging sentiment.

In layman’s terms, on-chain analysis involves observing how money moves on the blockchain to help discover potential investment opportunities.

This is an extremely popular strategy due to the sheer quantity of data available to traders. The unique insight into market movement through data availability doesn’t exist in traditional finance. Furthermore, it enables traders/investors to build a more intimate relationship with a market or an asset.

Advantages of On-Chain Analysis

With an overview of what on-chain analysis is, let’s look at some of the advantages of this strategy:

- Prevent Market Manipulation – With on-chain analysis, you can monitor transactions constructed to influence the market and, ultimately, mitigate their impact.

- Detect Fraudulent Behavior – On-chain analysis can aid in detecting fraudulent network behavior by tracking the movement of funds and finding suspicious transaction patterns.

- Investor Behavior – With on-chain analysis, you can gauge how a trading community feels about a certain crypto asset. For instance, if they HODL for a significant time, it shows genuine commitment.

Nevertheless, now that you know what on-chain analysis is and have explored some major benefits, let’s look closer at how this strategy works!

How to Use On-Chain Analysis for Crypto Trading

When conducting on-chain analysis, you examine various metrics in relation to the price action of specific digital assets. To better understand this, let’s look at two clear examples:

- Whale Watching – A prominent example of how to use on-chain analysis is called ”whale watching.” It’s generally safe to assume that large and prominent players know more about the market than retail traders and have a more significant market influence.

If an event occurs and large long-term holders continue to HODL, chances are that the current price fluctuations are nothing but a short-term racket. On the other hand, if these large investors start dumping their assets, investors should follow them toward the exit.

- Exchange Flows – Another example is exchange flows. Centralized exchanges are often seen as the banks of the crypto world where traders exchange fiat currency for crypto. A significant inflow of assets onto an exchange can sometimes mean incoming sell pressure as investors want to lock in profits. However, the same goes for the inverse: a large outflow of an asset from an exchange can indicate that investors intend to hold it. As such, by tracking these flows, traders can gain insight into overall market sentiment.

Whale watching and exchange flows are just two examples of using on-chain analysis. There are many other ways of using publicly available crypto data to make market predictions.

Nevertheless, when appropriately executed, on-chain analysis can be a powerful strategy for turning transaction data into actionable moves for investors!

On-Chain Analysis Metrics

Thousands of metrics and crypto signals are available, enabling traders to enhance the outcome of investment decisions. In this article, we won’t be able to cover them all. Instead, we’ll focus on a few on-chain analysis metrics and indicators worth keeping an eye on.

Transaction Volume

Transaction volume measures the total number of transactions on a blockchain over a given period. You can use this metric to assess network activity and demand for underlying assets. Analyzing transaction volume can help you identify patterns and trends in user behavior.

Active Addresses

Analyzing the number of active addresses on a network can provide insight into user adoption and engagement. For instance, an increase in active addresses can indicate the growth of a network or a particular asset. On the other hand, a decrease in active addresses signals a lack of adoption or interest. To track active addresses, you can monitor the number of unique wallets sending and receiving a particular asset on a network.

Supply Distribution

By analyzing the supply distribution on a network, you gain insight into the level of decentralization and concentration of cryptocurrencies. Supply distribution means the distribution of a cryptocurrency’s total supply among holders.

A more evenly distributed supply indicates a more decentralized network; meanwhile, a concentration of tokens among a few holders indicates a higher degree of centralization. To analyze this metric, you can trace the number and size of addresses holding a percentage of a currency’s supply.

The Drawbacks and Limitations of On-Chain Analysis

There are many benefits and advantages of on-chain analysis. However, to be more nuanced, let’s also cover some of the drawbacks and limitations:

- Querying Data – Even though the transaction data of a blockchain network is publicly available, it can still be quite challenging to acquire the information. Querying a blockchain network for transaction data is no walk in the park. Moreover, for people with less technical experience, it can take a lot of time.

- An Overwhelming Amount of Data – Since a blockchain network records all transactions, it can be an overwhelming amount of data that you need to keep track of when doing on-chain analysis.

- Interpreting the Data – Even if you manage to query a network and narrow down the large data set, you also need to interpret the information. This is also a difficult and time-consuming process.

So, how are people dealing with these drawbacks and limitations?

To make on-chain analysis easier, professional traders leverage on-chain analysis tools like Moralis!

Introducing Moralis – The Ultimate On-Chain Trading Indicator

Moralis is the premier on-chain trading indicator, helping people effortlessly find tokens before they pump. Moralis leverages real-time, unbiased, on-chain data, presenting it to users in a readable and understandable format.

If you have ever used other on-chain analysis tools, you already know that they provide complicated charts and metrics. With Moralis, we removed all the complexity, emphasizing user-friendliness. As a result, on-chain analysis has never been easier!

So, how does it work?

Moralis has three central features:

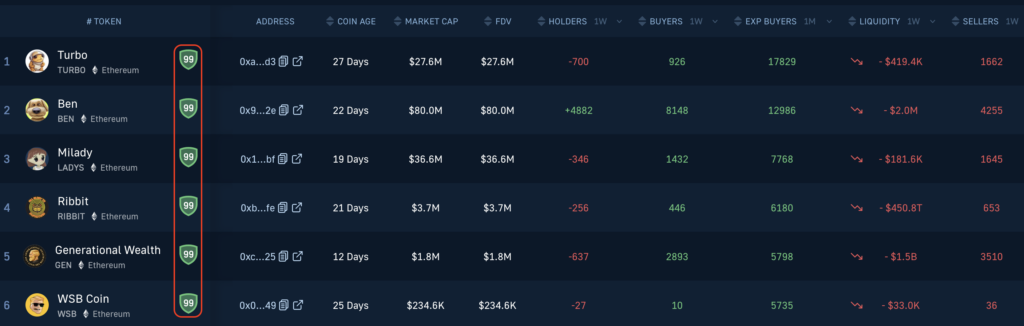

- Token Explorer – With token explorer, you can easily find the next 100x crypto. With this feature, you can combine various search parameters to set up custom filters and find the tokens you’re after:

- Token Alerts – Once you create a custom query using Token Explorer, you can use Token Alerts to set up email notifications. In doing so, you’ll receive email alerts whenever a new token matching your preferences emerge. This is how it works:

- Token Shield – Lastly, with Token Shield, you can easily dodge cryptocurrency scams. Just look for the shield symbol attached to each coin for a comprehensive security evaluation:

With an overview of the three central features of Moralis, let’s explore how you can use this tool for on-chain analysis!

How to Use Moralis to Alanyze On-Chain Data

With the Token Explorer feature, you can discover the next 1000x crypto and track tokens based on on-chain data. In fact, Moralis features 13 unique search parameters, allowing you to create fully customizable search queries to target specific tokens you’re after based on your preferred on-chain analysis metrics:

- Coin Age

- Security Score

- Liquidity

- Fully Diluted Valuation

- Market Cap

- Holders

- Buyers

- Experienced Buyers

- Sellers

- Experienced Sellers

- Net Buyers

- Experienced Net Buyers

- Social Media Metrics

From these metrics, you can pick and choose which ones to include in your search query. As such, you can effortlessly query the blockchain for tokens based on understandable and straightforward parameters.

For instance, let’s say you want to find coins that have seen a positive influx of liquidity over the past two weeks and are currently gaining traction from other buyers. If so, simply add the Liquidity and Experienced Buyers metrics to generate a list of altcoin gems:

It’s as easy as that to get tokens based on on-chain analysis metrics like liquidity, active addresses, transaction volume, holders, and much more!

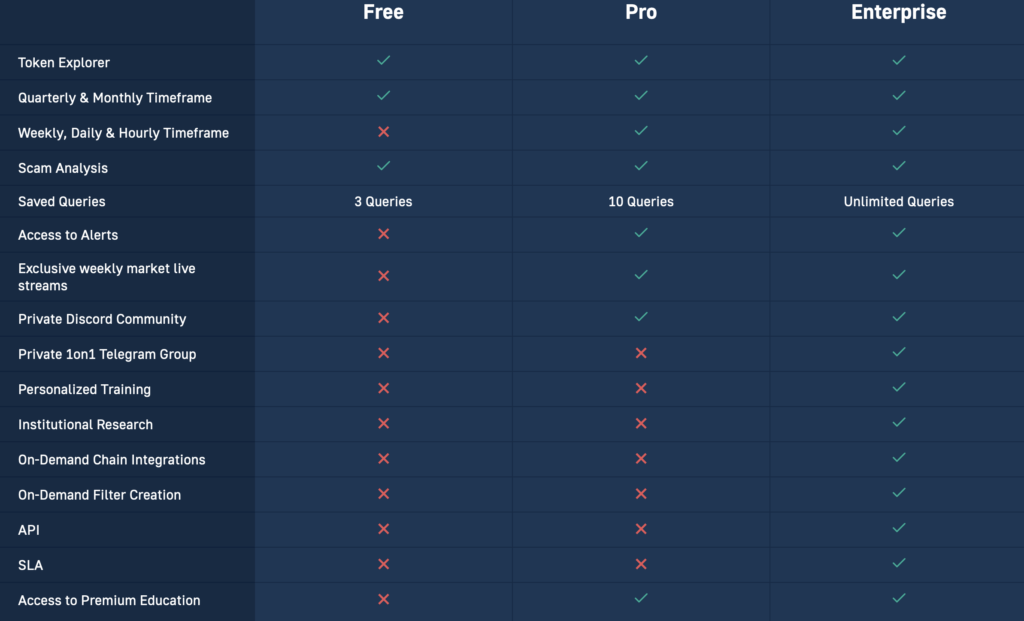

Note: If you want more narrow timeframes for all search parameters (daily, hourly, and every ten minutes), check out the Moralis Pro plan. Before Bitcoin hits $40k, you can get the Pro plan at a discount. So, take this opportunity to subscribe to the Moralis Pro plan, and we’ll honor the price for as long as you stay subscribed.

The Moralis Token Page

After finding a token you’re interested in, you can use the Moralis token page to monitor the token’s transaction data more closely. To visit a coin’s token page, click on it when using Token Explorer:

On this page, you can view everything from the token’s market cap to liquidity changes over a given period. What’s more, this page is fully dynamic. As such, you can change the timeframe for each alpha metric to see how a token has been performing both in the short and long term:

Also, by scrolling down, you can find trading charts and bubble maps with further information:

Summary – What is On-Chain Analysis?

Today’s tutorial explored the intricacies of on-chain analysis. In doing so, you learned that on-chain analysis is a method for analyzing on-chain data to make accurate cryptocurrency predictions. We also explored the difficulties of gathering the on-chain data, which is why traders turn to tools like Moralis!

Moralis is the premier on-chain trading indicator, providing on-chain analysis data in a readable and understandable format. Moreover, Moralis has three central features:

- Token Explorer – With Token Explorer, you can query tokens based on unique on-chain analysis parameters to find the latest crypto coins.

- Token Alerts – With Token Alerts, you can set up email notifications to get alerts whenever a new token matching your preferences emerge.

- Token Shield – With Token Shield, you can effortlessly protect yourself from scams.

Also, did you know that you can maximize the value of these three features with the Moralis Pro plan? By going Pro, you get access to more narrow timeframes for all search parameters, save up to ten search queries, set up five alerts, and much more!

Take the opportunity now before Bitcoin hits $40k, as we’ll bump up the price when it happens. So, as long as you subscribe before that, we’ll honor the original price for as long as you stay with us.

Finally, if you’re interested in other ways of making money with crypto, check out the number one Web3 affiliate program. As a Moralis affiliate, you can easily set up your affiliate marketing side hustle and begin your journey toward financial freedom. If this sounds interesting, become a Moralis affiliate today!